It’s no secret that a low credit score can make it difficult to borrow money. Many people assume that a credit score of 500 or below automatically disqualifies them from getting a loan. However, this is not entirely true. While a low credit score can certainly make it harder to get approved for a loan, it doesn’t necessarily mean that it’s impossible. In this blog post, we’ll explore the different types of loans available for those with low credit scores, as well as alternative ways to get the cash you need.

Understanding Your Credit Score

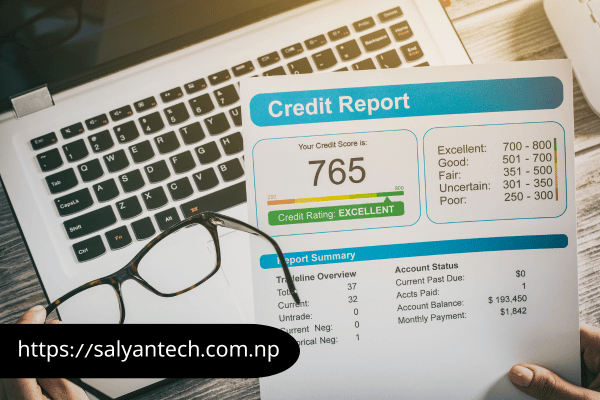

Before we dive into the different types of loans available, it’s important to understand what a credit score is and how it’s determined. Your credit score is a three-digit number that represents your creditworthiness. It’s based on a variety of factors, including your payment history, amount of debt, length of credit history, and types of credit used. The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850.

Having a low credit score can impact your ability to borrow money in a few ways. First, many lenders use credit scores as a way to assess risk. If you have a low credit score, lenders may view you as a higher risk borrower and be less likely to approve your application. Additionally, even if you are approved for a loan, you may face higher interest rates and less favorable loan terms.

Types of Loans Available for Low Credit Scores

Now that we’ve covered the basics of credit scores, let’s explore the different types of loans available for those with low credit scores. It’s important to note that not all lenders offer loans to those with low credit scores, and those that do may have higher interest rates and stricter loan terms. With that said, here are a few types of loans to consider:

Payday Loans:

Payday loans are short-term loans that typically have very high interest rates. They are designed to be repaid on your next payday and are often used as a last resort option for those in need of quick cash. While payday loans may be an option for those with low credit scores, they can be very expensive and should be approached with caution.

Secured Loans:

Secured loans require some form of collateral, such as a car or home, to back up the loan. This can make it easier to get approved for a loan with a low credit score, as the lender has something to fall back on if you can’t repay the loan. However, if you default on a secured loan, you risk losing your collateral.

Personal Loans:

Personal loans are unsecured loans that can be used for a variety of purposes, such as debt consolidation, home improvements, or unexpected expenses. While personal loans may be more difficult to get approved for with a low credit score, some lenders specialize in working with borrowers who have poor credit.

Each type of loan has its own pros and cons, and it’s important to carefully consider your options before applying. Some loans, such as payday loans, can be very expensive and may not be worth the risk. Others, such as secured loans, require collateral and can be risky if you’re unable to repay the loan.

How to Improve Your Chances of Getting Approved

If you have a low credit score and are struggling to get approved for a loan, there are a few things you can do to improve your chances:

Build Your Credit:

One of the best ways to improve your chances of getting approved for a loan is to work on building your credit. This can include things like paying your bills on time, paying down debt, and disputing any errors on your credit report.

Find a Cosigner:

If you have a family member or friend with good credit, they may be willing to cosign on a loan for you. This can help you get approved for a loan and may also result in more favorable loan terms.

Provide Collateral:

As mentioned earlier, secured loans require collateral to back up the loan. If you have an asset, such as a car or home, you may be able to use it as collateral to improve your chances of getting approved.

Alternatives to Traditional Loans

If you’ve exhausted your options for getting a loan but still need cash, there are a few alternative options to consider:

Borrow from Friends or Family:

While borrowing money from loved ones can be awkward, it’s often a better option than turning to high-interest loans. If you do choose to borrow from someone you know, be sure to set clear repayment terms and stick to them.

Sell Unwanted Items:

If you have items you no longer need or use, consider selling them to make a little extra cash. You can sell items online through sites like eBay or Facebook Marketplace, or host a garage sale.

Conclusion

While having a low credit score can make it more difficult to get approved for a loan, it doesn’t mean that it’s impossible. By understanding your credit score, exploring different types of loans, and taking steps to improve your credit, you can increase your chances of getting approved for a loan. Additionally, if traditional loans aren’t an option, there are alternative ways to get the cash you need. Whatever your situation, it’s important to approach borrowing money with caution and carefully consider your options before making a decision.

Read Also: The Power of SIP Calculators for Smarter Investing